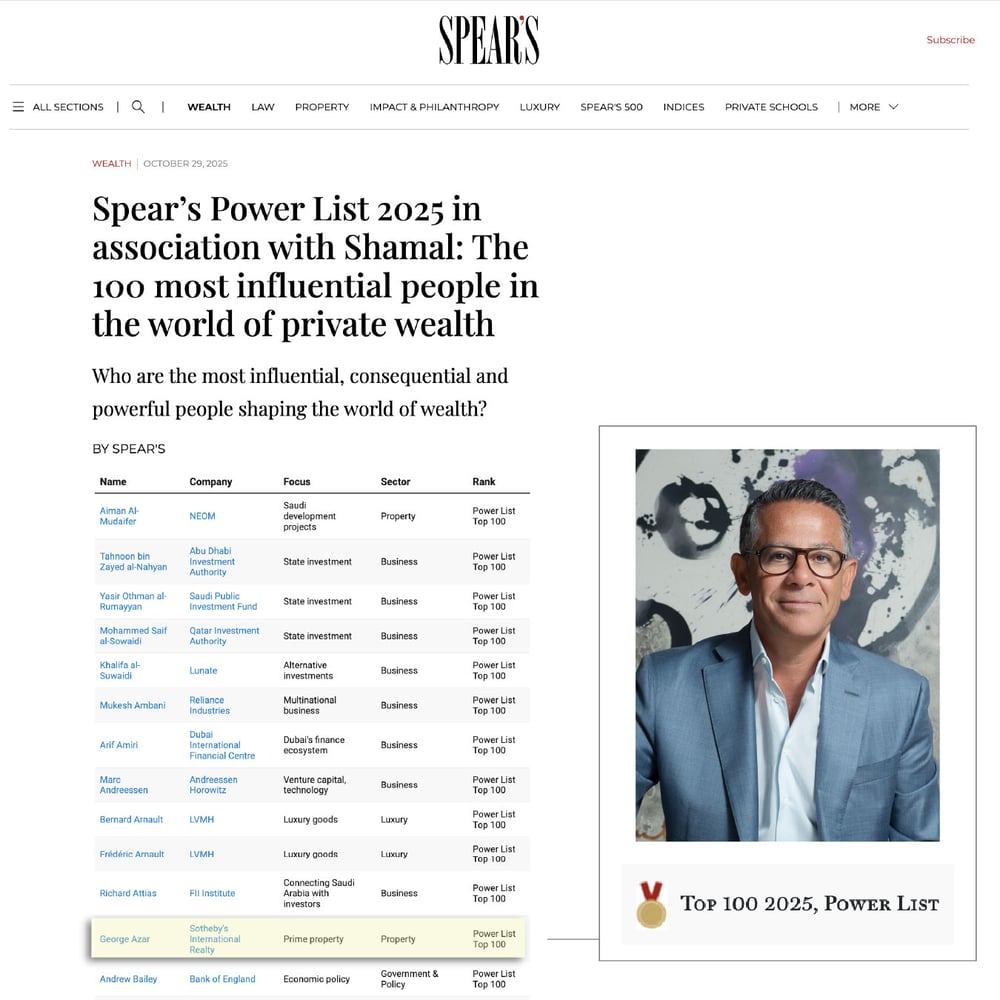

George Azar Named Among the 100 Most Influential in Private Wealth 2025 – Spear’s Power List

Published: 17 November 2025

In the final quarter of each year, Spear’s Magazine releases its ‘Power List’ – a definitive ranking of 100 people shaping the world of private wealth. From CEOs and private bankers to asset managers, lawyers, and family office advisers, the list is built on results and substance rather than visibility, recognising those who have moved markets in a meaningful, measurable way. Familiar names have included Bernard Arnault and Sir James Dyson – standout figures whose decisions shape markets far beyond their industries.

In 2025, George Azar joined that circle. As Chairman and CEO of Sotheby’s International Realty in Dubai, the UK, Saudi Arabia – and most recently, Abu Dhabi – George has helped steer regional real estate markets into previously uncharted territory. Described by Spear’s as a “visionary leader,” the magazine noted: “Over nearly two decades, [Azar] has become one of the most influential figures in the industry, known for redefining the standards of service, discretion and performance in the super-prime residential market”.

Drawing on his background in banking, Spear’s also commended his ability to “anticipate market movements and align with the lifestyle aspirations of the world’s wealthiest clientele” – a quality that, in their words, marks him out as an industry trailblazer. From building Dubai Sotheby’s International Realty into a UAE powerhouse to “supercharging” the UK business, it’s an accolade well earned.

Read on as we trace the journey behind the recognition.

2013 – Dubai Sotheby’s International Realty Opens Its Doors

In 2011 and 2012, the Dubai real estate market was still finding its footing after the 2008 financial crash. Inventory outpaced demand and confidence was tentative at best, but for those paying attention, the conditions for a comeback were already taking shape. Firm in the belief that the city was on the cusp of something bigger, George acquired the franchise rights for Sotheby’s International Realty in Dubai – a decisive pivot from the high-gloss world of banking. With no systems or infrastructure yet in place, the operation started from scratch, building the team, technology, and brand presence from the ground up.

Over the next decade, George would transform the office into a market-shaping force within Dubai’s prime and super prime segments, blazing the trail across resale, off-plan, and – more recently – the branded residence segment.

The company’s biggest inflection point came post-pandemic. In 2020 – a time of radical economic uncertainty – many firms scaled back operations to hedge against risk. Under George’s leadership, Dubai Sotheby’s International Realty did the opposite, embracing volatility as an opportunity: scaling talent and deepening developer relationships. High-net-worth buyers poured into the city, quickly pushing demand far beyond supply.

Growth accelerated year-on-year, and by 2025, the firm had amassed a growing number of industry-defining records: the most expensive home on Jumeirah Bay Island (a record it broke itself – twice), the most expensive plot on Palm Jumeirah, and exclusivity over the city’s most prestigious branded residences, including Baccarat and Four Seasons.

2023: The “Golden Triangle” Emerges, Bridging the UK, Saudi Arabia, Dubai

In 2023, George conceptualised a new strategic arc – one that would link the Gulf to London in a way that few had attempted at scale. Termed the “Golden Triangle,” this vision saw Sotheby’s International Realty positioned across three significant wealth corridors: Dubai, Saudi Arabia, and the United Kingdom.

Historically closed to international interest, Saudi Arabia began a new chapter in 2021 under the framework of Vision 2030. Giga-projects started to redraw the map, social reforms opened the door to a more global demographic, and for the first time, foreign interest in high-end real estate began to accelerate. Led by George, alongside Managing Partner Erick Knaider, Saudi Arabia Sotheby’s International Realty stepped confidently into this space, supported by an expert local team and meaningful ties to the Kingdom’s most impactful developers, including Diriyah Company and Red Sea Global.

Exclusive sales rights to The Red Sea’s flagship developments placed the firm in a category of its own, alongside a growing portfolio of heritage-led projects in Diriyah and other culturally-rich cities.

2023 also marked a landmark move westward: the acquisition of United Kingdom Sotheby’s International Realty. Announced in early Q1, the deal was a philosophical alignment as much as a strategic one, bringing the brand back home to where Sotheby's itself first originated: London, est. 1744.

The move united two powerful markets, bringing further liquidity to London’s long-established super prime landscape. Today, United Kingdom Sotheby’s International Realty serves communities both in Prime Central London and the fast-growing countryside commuter belt, including Surrey and South West London, operating across eight locations. In 2024, a dedicated Family Office division was launched, providing a discreet, full-circle advisory platform across residential real estate, art, automotive, and cross-border investment.

The Capital Chapter: Abu Dhabi Joins the Portfolio

With Dubai well established and the Saudi and UK markets operating at full pace, George launched Abu Dhabi Sotheby’s International Realty in 2025 – a market that’s poised for significant growth. Historically more measured than its neighbouring Emirate, Abu Dhabi’s real estate market is evolving rapidly, emerging as the calmer, more culturally-rich counterpart to Dubai. "After witnessing Dubai’s tremendous economic growth over the past few years, Abu Dhabi is now primed to step into the spotlight,” said George. “The emirate has positioned itself as a key investment and financial hub, supported by the rise of family offices and visionary government planning in culture, sustainability, and infrastructure. This is a natural transition for us.”

Transaction volumes show the bigger picture. With AED 92 billion recorded year-to-date in 2025, the market has more than doubled in value over the past five years. One of Abu Dhabi Sotheby’s International Realty’s first sales set the tone: a record-breaking AED 200 million penthouse at Four Seasons Private Residences Saadiyat – the most expensive apartment ever sold in the capital. This development alone has already crossed AED 14.7 billion in sales through Abu Dhabi Sotheby’s International Realty – a sharp indicator of what’s building.

Final Thoughts

Recognition in the Spear’s Power List is rarely about profile alone – it’s a reflection of strategy, consistency, and impact across markets that matter. In a sector driven by performance, George’s inclusion in 2025 is a measure of exactly that: from nurturing the right talent to knowing exactly when to expand into a new geography. It also marks the increasing presence of the Gulf in global real estate – a shift that George has undoubtedly helped accelerate.